By now we all know that employers with more than 50 full-time equivalent employees are mandated to offer “affordable” coverage to all “full-time” employees. But what does that mean, exactly? Affordable coverage has most recently been defined as having an employee premium that is less than 9.5% of each eligible employee’s income, and full-time employees are those employees who work in excess of 30 hours on average per week. This seems fairly straightforward in most industries, but it does pose some reporting and time keeping challenges.

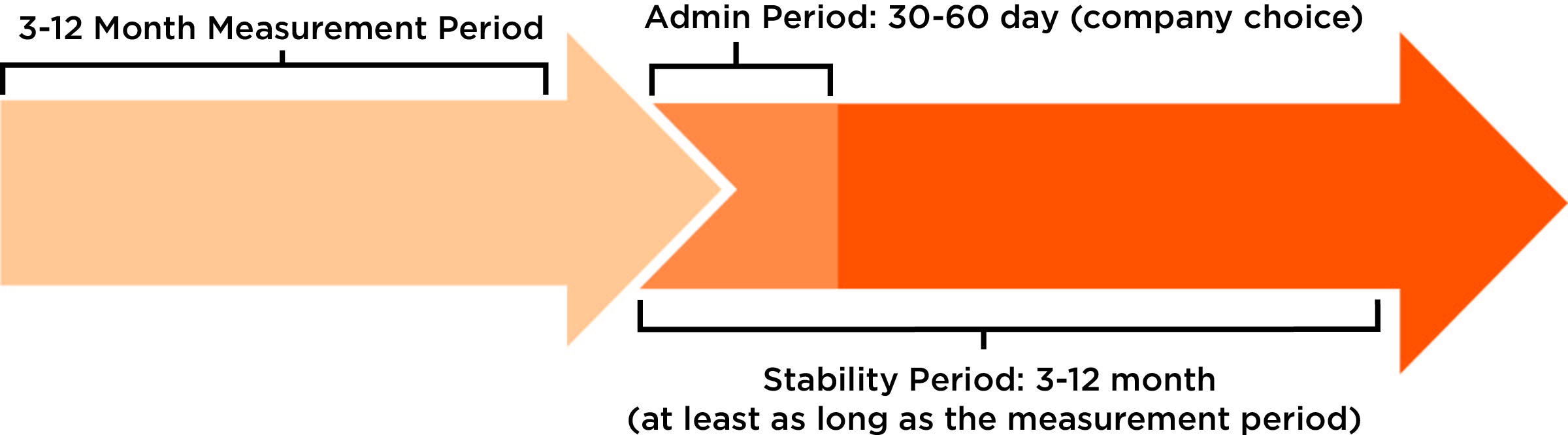

To further knot up the situation, the 30-hour average applies to variable-hour employees, too, and each employer gets to determine the time frame in which to assess the status of each employee. This time frame, known as a “measurement period,” can be as short as 90 days or as long as a year. Any employee who averages more than 30 hours during the measurement period must be enrolled in benefits during a 30- or 60-day administrative period that follows.

Whether an employee qualifies and is enrolled or not, he or she enters another measurement period (this time referred to as the stability period) right away. If the employee has been enrolled in benefits, he can’t be taken off during this period, even if he’s working 15 hours per week. And if the original measurement period was a year long, that means another year of benefits for an employee who wouldn’t and won’t qualify for benefits at the end of that measurement period.

I have done the best I can to illustrate the way the measurement periods look below:

To reiterate, because I know this trips people up: When the initial measurement period ends, those who have been classified as part time but work in excess of 30 hours a week on average will be given a 30-60 day window in which to enroll in benefits or sign a waiver. Those full-time or as-needed employees who have not worked in excess of 30 hours per week on average may be removed from the health plan. While the 30-60 day administrative period begins, so too, does the stability period, as well as the next measurement period.

The problem, of course, arises when you consider variable hour employees. If you’re operating a seasonal business or one that for whatever reason includes long-term employees who work widely varying hours, the Act becomes something of a minefield of regulations that I imagine will have to be sorted out in the courts.

Keeping careful track of your employment data and having an automated timekeeping and reporting mechanism is going to be the saving grace for every employer trying to navigate the regulations. We’ll keep following the details of the changes the Act necessitates—and the surely high volume of legal wrangling and court cases that will go along with it—so that we can keep our clients on the right side of regulations.