No matter which side you end up on regarding the employer mandate of the Affordable Care Act, accurate data and real-time reporting are going to be key for proving compliance. Maybe you’re hovering around 50 full-time equivalent (FTE) employees, or maybe you’re adamant about maintaining groups of non-exempt employees in part-time status—either way, you’re going to have to show that you’re staying on the right side of regulations.

Fines associated with the employer mandate will take effect January 1, 2015, which means now is the time to begin to calculate FTE and average hours worked and decide how to remain compliant with the law without sacrificing human capital. Now is the time to choose your strategy and put systems in place to ensure that your strategy doesn’t end up creating a financial liability.

The Internal Revenue Service will enforce the ACA and collect fines when fines are due; however, proving you’re in compliance falls to you. Each business is obligated to defend its position and produce the reports that show it’s following the mandate. You can do that tediously and expensively, or you can upgrade your systems so that you’re able to pull the data you need in an instant.

I recently had an attorney reference a “shoe box full of time cards” presented to him by a small municipality so that he could attempt to perform a proactive health care reform compliance audit. While this attorney may be capable of producing a backward-looking report of average hours worked for each employee within each individual’s unique measurement period based on hire date, he won’t be doing that quickly or cost-effectively. And how will this municipality ensure future compliance and avoid huge fines? The most practical answer is through 21st-century time keeping and reporting technology.

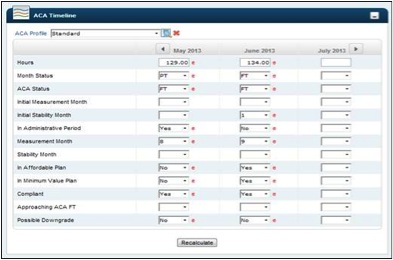

I know of only one integrated solution, and we use it. Axiom’s Workforce Ready is a Kronos product that can be tailored to time and labor management tracking that produces all of the relevant, accurate, and useful reports that prove and maintain compliance with the ACA.

The decisions you make now can make a big difference in how your business navigates the ACA. As a company focused on compliance and risk management, we just can’t urge you strongly enough to back up your ACA strategy with forward-looking technology that tracks data efficiently and safeguards your business.

If you’d like to learn more about what the Affordable Care Act might mean for your business, check out this video explaining what you should know from an information, technology, and overall compliance viewpoint.