Payroll headaches are so common in business, we’re surprised there’s not an over-the-counter remedy marketed specifically at alleviating them. Even if you and your employees manage to track all their time accurately—and this is pretty easily streamlined with the use of a web-based time management system—completing payroll in a consistent, compliant, and accurate manner is still a regular challenge for businesses.

The following are four of the most common headaches employers face when it comes to payroll, followed by the compliance cure:

Misclassifying Employees

Even small businesses may rely on several types of labor during their business year. Besides full-time and part-time permanent employees, businesses may rely on temporary, freelance, and contract workers to get the job done.

While all these types of workers have their proper place in the workforce, not all are properly classified. Because the law doesn’t require withholding or payment of taxes and Social Security for properly classified independent contractors, many businesses see independent contractors as an attractive alternative to hiring full-time employees.

The problem: Back taxes and penalties can result when businesses misclassify workers who are de facto employees as independent contractors.

The solution: Realize that it’s the substance of the employer/employee relationship that matters for compliance purposes, not the name you put to it. IRS Publication 15-A offers specifics about the proper classification of employees and independent contractors.

Overtime Rule Violations

Look for overtime pay errors to become an even bigger issue in years to come, as the U.S. Department of Labor (DOL) reconsiders the overtime exemption rule under the Fair Labor Standards Act. Although the Obama-era increase of the salary threshold has been struck down, the DOL’s June 2017 request for information has led speculation that a more modest increase is still in the works.

The problem: Determining eligible employees. Unless they are exempt, employees who work more than the maximum allowable hours per week for their type of employment (usually more than 40 hours per week) are entitled to time-and-a-half pay (at least) for their overtime hours. The DOL offers a partial guide to employees who are exempt from this rule. But there are unlisted exemptions, such as those that apply for some employees of auto dealers.

The solution: Know the overtime rules that apply to each of the types of workers you employ, as well as the rules that apply to your industry. Your local Wage and Hour Division office or reliable human resource professionals can provide you with more detailed information.

Confusing Pre-Tax and Post-Tax Payroll Deductions

Pre-tax deductions are taken out of gross earnings before taxes. They reduce employee tax obligations and employer tax expenses. They’re most commonly applied for employees deducting their share of health, dental, and vision premiums under an active Section-125 cafeteria plan, or making elective-deferral contributions toward their company-sponsored retirement plans.

The problem: Not all pre-tax deductions are treated alike. Elective-deferrals, for example, reduce the employee’s Federal and State taxable wages, but not their FICA wages. Section-125s must be renewed annually. There are different deduction rules regarding different types of supplemental insurance (such as those provided by AFLAC).

The solution: Make sure you’re very clear about the rules governing each type of pre-tax and post-tax deduction, and that you apply them consistently. Be cautious when relying on off-the-shelf accounting software: It can be easy to accidentally override the default taxation settings without realizing it.

Garnishment Violations

Wage garnishment, while not widespread, is more common than one might think: According to data from 2013, seven percent of employees had their wages garnished that year, and the rate was 10.5 percent for employees between the ages of 35 and 44.

The problem: Wage garnishments take the form of a court order. Penalties for employers who fail to comply correctly and in a timely manner can be costly—and have in some cases resulted in an employer being held liable for all of an employee’s debt. Adding to the risk and confusion, state laws currently differ when it comes to compliance (though a 2016 uniform law drafted by the Uniform Law Commission may provide some relief, if states choose to adopt it).

The solution: Don’t wait to take action on garnishment orders, even—in fact, especially—if the order seems erroneous. Take into account the type of debt owed, the party collecting it, and the laws that apply to the debt.

Don’t Go It Alone

Most of all, when it comes to payroll or any type of compliance issue, don’t assume that what seems likely or makes common sense will result in compliance—or that not understanding the law will protect you. In other words, a one-size-fits-all approach doesn’t always make sense and, in some cases, may make your payroll headache worse.

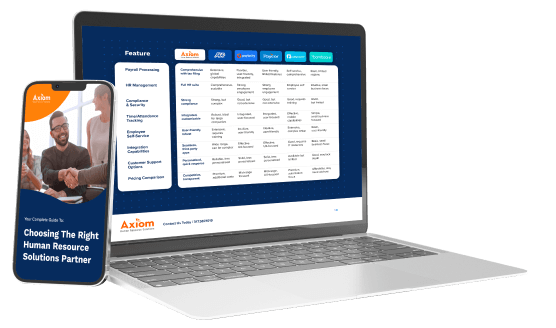

If you’d like professional guidance on pay and labor issues, or would like to explore how a web-based payroll solution can provide your business peace of mind, contact an Axiom representative today.