Over the last few years, the Affordable Care Act (ACA) has brought broad changes to employers offering health insurance to their employees. Many thought these changes would result in drastic increases in the cost of health care for business owners. But luckily for most employers, this hasn’t been the case.

Over the last few years, the Affordable Care Act (ACA) has brought broad changes to employers offering health insurance to their employees. Many thought these changes would result in drastic increases in the cost of health care for business owners. But luckily for most employers, this hasn’t been the case.

According to the ADP Research Institute’s 2015 Annual Health Benefits Report, the biggest challenge for companies regarding the ACA wasn’t increasing costs—it was being compliant with new mandates. This can be attributed to the many and sometimes difficult-to-understand ACA reforms dealing with tax filings, reporting, employee participation, and a variety of other areas.

But when it comes to a company’s bottom line, the ACA hasn’t had much of an effect on many employers. This can be attributed to several factors covered in the 2015 ADP Annual Health Benefits Report.

The biggest factor in why health coverage costs aren’t rising as fast as many expected for employers is that premiums are rising relatively slowly. For the past five years, they’ve gone up roughly two percent each year, which is a lower rate than a decade ago. There are many factors keeping premiums low, but high-deductible plans with high co-pays being implemented by an increasing number of employers constitutes a big part of it.

Another reason costs are staying low is because eligibility rates are going up, but actual participation in company health plans has stayed the same. This may be happening because workers are seeking alternate forms of coverage. It also probably has something to do with the extended dependent coverage provision—part of the ACA—that allows people under the age of 26 to stay on the same plan as their parents.

A final reason for relatively steady healthcare costs for employers is due to shrinking variance in premiums in relation to industry. Some industries outlined by the ADP Research Report, like Trade, Transportation, and Utilities, saw a big jump in premiums during the last five years—over 11 percent. Others, like Professional Business Services, went up less than six percent. But since the ACA has put limits on premium costs starting in 2018 with an excise tax, industries should continue to move toward lower levels of cost variance.

The impact of the ACA hasn’t fully been seen yet, but so far, realized healthcare costs haven’t ballooned as much as many politicians and business owners anticipated. But there are still plenty of questions to be answered regarding the ACA, so don’t start celebrating the lower-than-anticipated costs of healthcare coverage just yet!

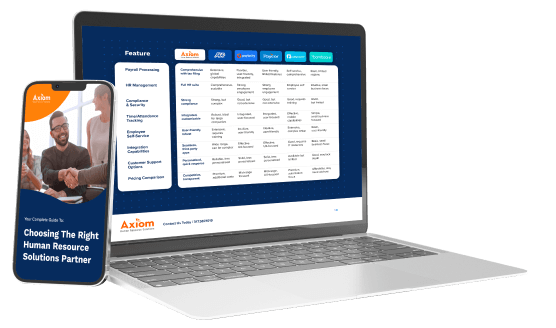

For more information on navigating the murky waters of ACA, download our latest presentation.